The 1099-MISC vs 1099-NEC debate boils down to purpose and boxes: NEC reports nonemployee compensation; MISC reports rents, prizes, and gross proceeds — use the right form to avoid penalties.

Table of contents

- Why this matters

- At-a-glance: 1099-MISC vs 1099-NEC

- Who gets which form and when

- Attorney payments: the nuance that confuses everyone

- Deadlines and filing tips to avoid penalties

- Common mistakes and how to fix them

- Checklist before you send 1099s

- Conclusion

- FAQ

Why this matters?

Getting 1099-MISC vs 1099-NEC wrong forces rework, draws IRS notices, and can trigger penalties. For payers, accuracy protects cash flow and reputation. For recipients, correct forms prevent surprise tax bills and make tax-season math simpler. The IRS uses these forms to cross-check tax returns, so match the payment to the correct box and form.

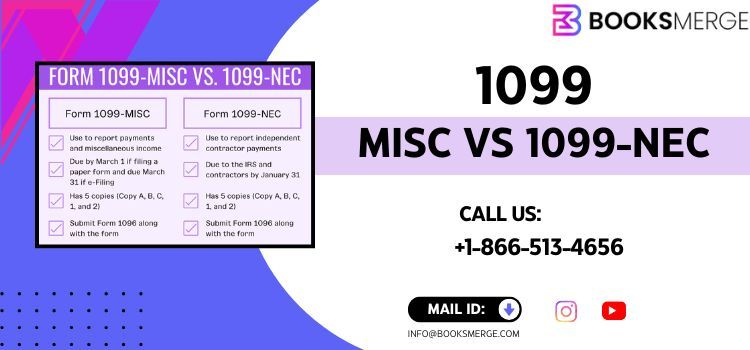

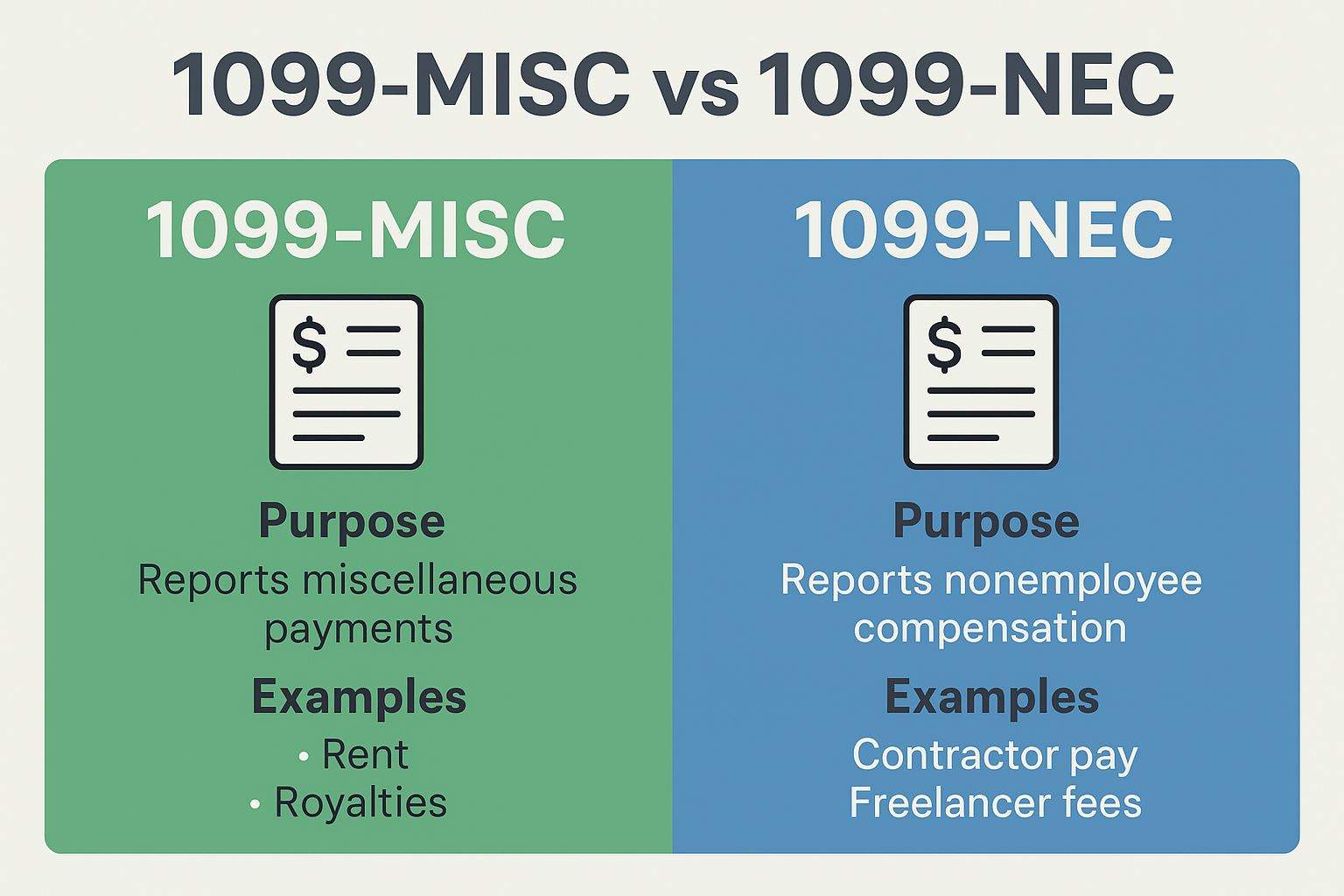

At-a-glance: 1099-MISC vs 1099-NEC

Keep this simple rule in your pocket:

- Form 1099-NEC — Use for nonemployee compensation paid in the course of business to someone who is not your employee. This is where you report contractor and freelance fees.

- Form 1099-MISC — Use for miscellaneous payments such as rent, royalties, prizes, awards, and certain other types of income; also used to report gross proceeds to attorneys in specific situations.

This short comparison answers most of the “which form?” questions quickly. When in doubt, check the Instructions for Forms 1099-MISC and 1099-NEC before you file.

Who gets which form and when

Answer these three quick questions for each payment:

- Who performed the work? If the worker is not an employee and you paid them for services, think NEC.

- What type of payment was made? Rent and royalties typically go on MISC.

- Is the amount reportable? Most business payments of $600 or more require a 1099, but rules and thresholds vary by form and situation.

Examples

- Paying a web designer $2,500 for a contract job → 1099-NEC.

- Paying $1,200 in office rent → 1099-MISC.

- Paying a legal settlement to someone’s attorney for $20,000 → 1099-MISC Box 10 for gross proceeds, sometimes with additional reporting nuance.

Attorney payments: the nuance that confuses everyone

This is where many small businesses trip up when comparing 1099-MISC vs 1099-NEC.

- Attorney fees for services paid directly to an attorney or law firm generally go on Form 1099-NEC when the payment is for services and meets the reporting threshold.

- Gross proceeds paid to an attorney (for example, a settlement paid to an attorney who then distributes funds to a claimant) appear on Form 1099-MISC Box 10. In short, service fees and gross proceeds can be different boxes and different forms.

Law firms and payers must read the instructions carefully because the rules do not always follow intuition. When a payment might fall into either category, document the nature of the payment and consult guidance or a tax pro.

Quick Tip: The IRS form list helps you identify, download, and file the correct federal tax forms needed to report income, claim deductions, and stay compliant with IRS rules.

Deadlines and filing tips to avoid penalties

Deadlines differ between the two forms, so mark your calendar:

- Form 1099-NEC: Furnish to recipient and file with the IRS on or before January 31. The NEC deadline is strict because the IRS uses it to match contractor income early.

- Form 1099-MISC: Deadlines vary by box and whether you file on paper or electronically. If filing on paper, the typical deadline historically falls later than NEC; e-filing deadlines extend slightly further. Always check the current year's instructions for exact dates.

Filing tips

- E-file when possible. It reduces errors and speeds processing.

- Order official red-ink Copy A forms from the IRS for paper filing.

- Use a TIN matching service or request Form W-9 to confirm taxpayer identification numbers before payments.

Common mistakes and how to fix them

Mistakes happen. Here are the most frequent errors when handling 1099-MISC vs 1099-NEC and how to correct them:

- Using the wrong form — If you filed NEC but should have used MISC, file a corrected return following IRS instructions.

- Wrong box — Put the amount in the proper box; gross proceeds to attorneys belong in Box 10 of MISC, not NEC.

- Missing TINs — Obtain a completed Form W-9 before paying contractors. If a payee refuses, backup withholding rules might apply.

Errors can produce penalties, but the IRS provides clear steps to correct mistakes. Correct early and document what you changed.

Checklist before you send 1099s

Use this quick checklist to keep your filing clean:

- Confirm the recipient’s legal name and TIN via Form W-9.

- Classify the payment: service, rent, royalty, gross proceeds, etc.

- Choose the correct form: 1099-NEC for nonemployee compensation; 1099-MISC for most other reportable payments.

- Verify thresholds: many reportable payments start at $600, but check instructions for exceptions.

- Keep records of why you chose NEC or MISC in case the IRS questions the filing.

If you want a custom checklist for your business type, BooksMerge can prepare one and even file on your behalf. Call +1-866-513-4656.

Conclusion

The 1099-MISC vs 1099-NEC choice comes down to the payment type and IRS definitions. Use NEC for nonemployee compensation and MISC for miscellaneous income and gross attorney proceeds when applicable. Accurate classification prevents penalties, speeds tax preparation, and protects your business. When complexity rises — for example, attorney payments or split payments — get professional help. BooksMerge specializes in bookkeeping and information returns and can help you stay compliant. Contact us at +1-866-513-4656.

FAQ

Q: Which form do I use to report contractor pay?

A: Use Form 1099-NEC to report nonemployee compensation paid in the course of your business. Confirm the $600 threshold and file by the NEC due date.

Q: Where do I report rent or royalties?

A: Report rent and royalties on Form 1099-MISC in the appropriate boxes when payments reach the reporting threshold.

Q: Are attorney payments reported on NEC or MISC?

A: It depends. Attorney service fees usually go on 1099-NEC while gross proceeds to attorneys go on 1099-MISC Box 10. Check the instructions for your facts.

Q: What if I filed the wrong form?

A: File a corrected return as soon as you discover the error; follow IRS steps to correct the form and notify the payee.

Q: Can BooksMerge help me file 1099s?

A: Yes. BooksMerge prepares, checks, and files information returns and can help set up processes to avoid mistakes. Call +1-866-513-4656.

Read Also: IRS form list